Average Retirement Allowance in Japan

Retirement allowances are unique to your employer, and the amount you get varies from person to person. This article shows the average amount and trends of retirement allowances in Japan.

Retirement allowances are highly individualized

What is retirement allowance in the first place? Generally, retirement allowance is regarded as a form of payment of wages later as part of working conditions in Japan.

The Labor Standards Act does not provide for retirement allowances. Whether or not retirement allowances are paid and the calculation formula, etc. are determined by internal regulations such as work rules. Therefore, they are highly individualized.

Statistics Reveal Retirement Allowances

Although it is highly individualized, it is possible to grasp a general trend statistically. Let’s take a look at the data collected by the Central Labor Relations Commission and the Ministry of Health, Labour and Welfare under certain conditions.

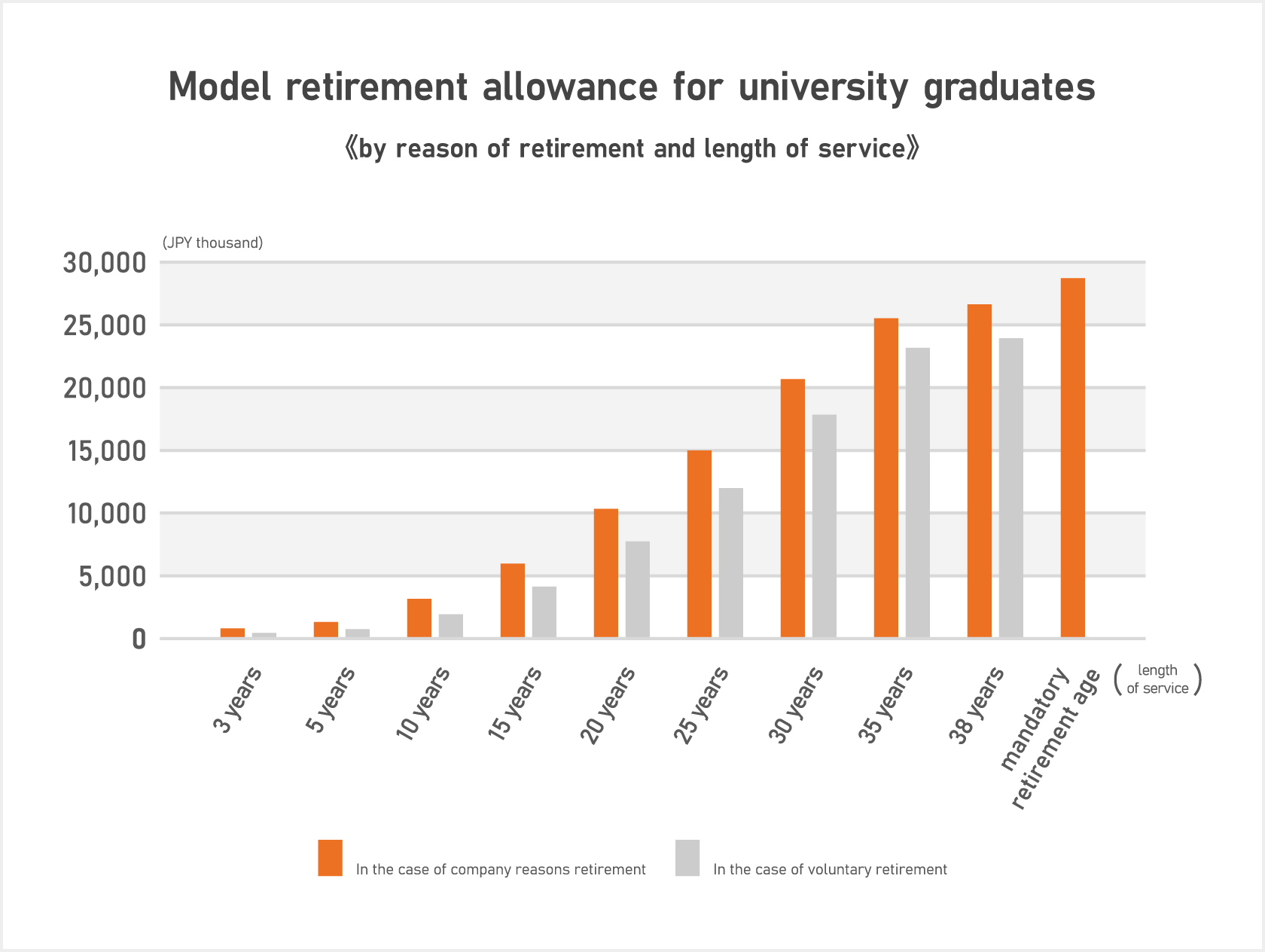

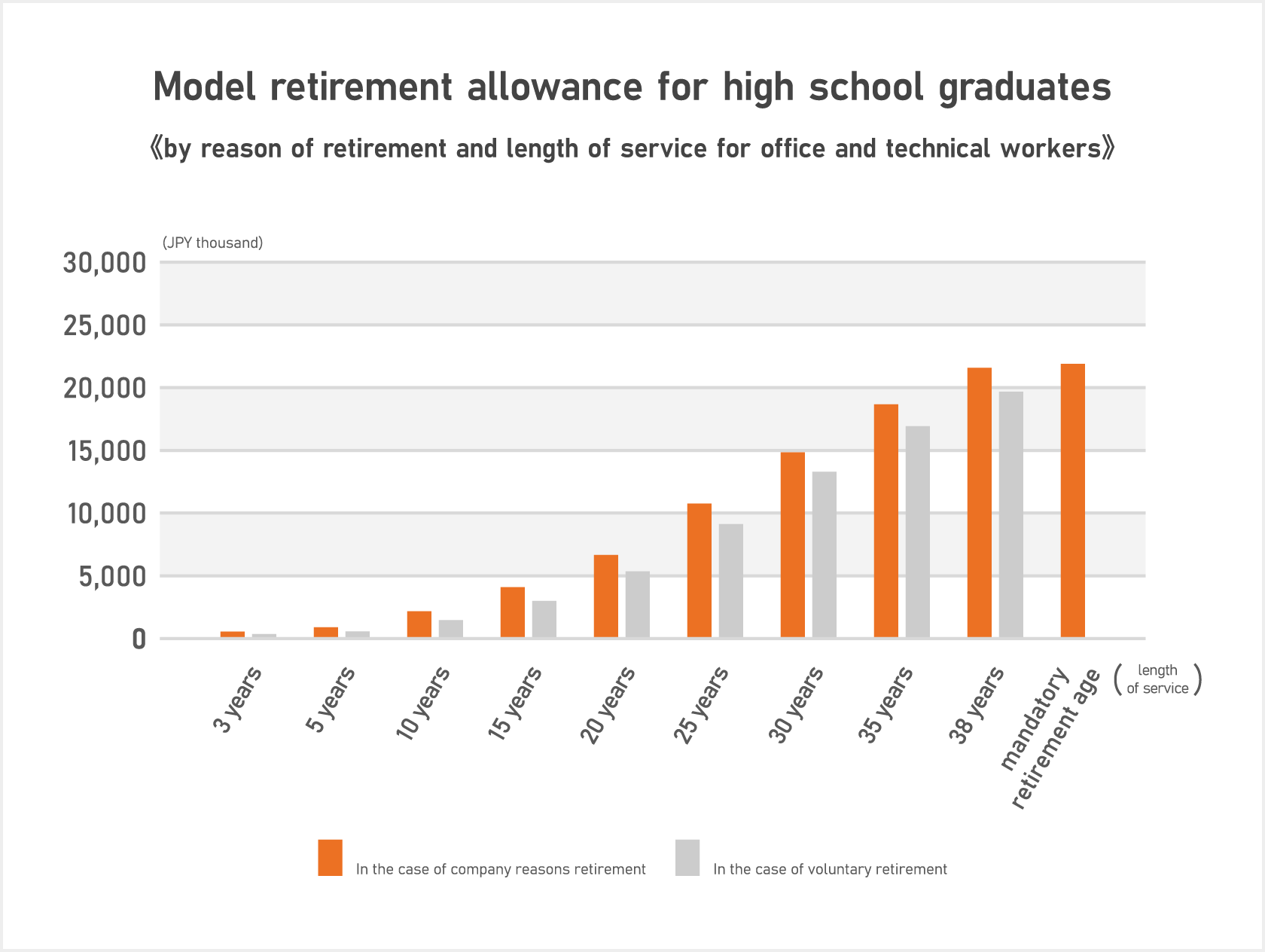

The data compares severance pay amounts for university and high school graduates classified as “clerical/technical workers, equivalent to comprehensive-track employees,” based on survey averages for cases of termination (“company reasons”) versus resignation (“personal reasons”). The comparison shows that the longer the tenure, the higher the severance pay, and that university graduates tend to receive higher levels of severance pay than high school graduates.

The table below shows the difference between company reasons and voluntary reasons according to the length of service. It can be seen that when a person retires for voluntary reasons after a short period of service, the amount of retirement benefits received is only about half that of company reasons, and when a person continues to serve for a long period of time, the difference is narrowing.

In this way, looking only at retirement benefits, it can be said that changing jobs after a short period of time is often a relative loss.

Model Retirement Allowance by Reason for Retirement and Length of Service(University graduate/JPY thousand)

| length of service | 3years | 5years | 10years | 15years | 20years | 25years | 30years | 35years | 38years | mandatory retirement age | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Age | Age25 | Age27 | Age32 | Age37 | Age42 | Age47 | Age52 | Age57 | Age60 | ||

| A | In the case of company reasons retirement | 696 | 1,213 | 3,057 | 5,851 | 10,216 | 14,875 | 20,545 | 25,395 | 26,509 | 28,584 |

| B | In the case of voluntary retirement | 341 | 631 | 1,828 | 4,027 | 7,619 | 11,863 | 17,718 | 23,039 | 23,808 | |

| A / B | 49% | 52% | 60% | 69% | 75% | 80% | 86% | 91% | 90% | ||

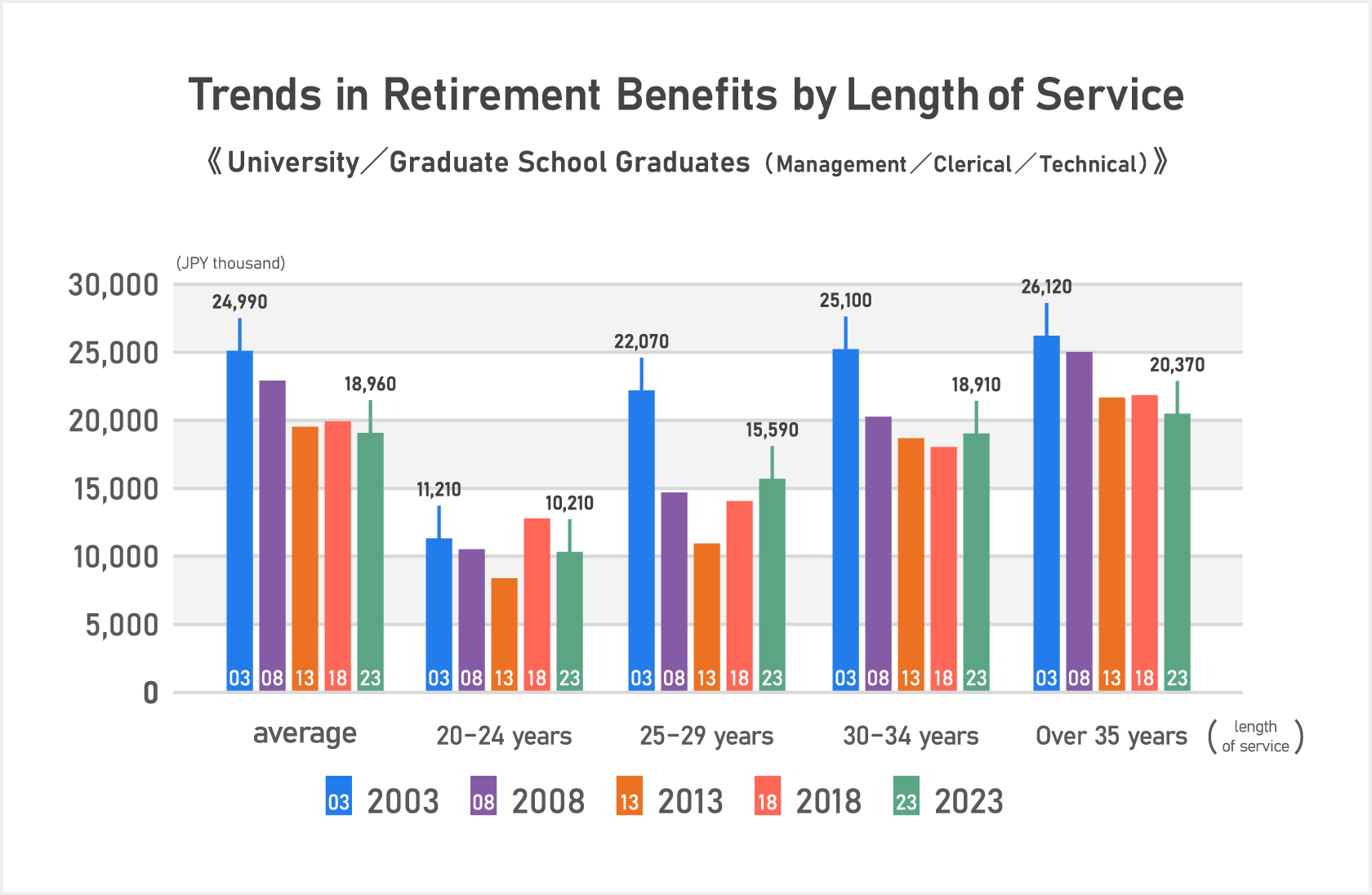

Retirement benefits are on the decline

According to another study by the Ministry of Health, Labour and Welfare (the Comprehensive Survey of Working Conditions), the level of retirement benefits is on the decline for all years of service. Looking at the overall average, the amount of retirement benefits decreased by 6.03 million yen over the 20 years from 2003 to 2023, or minus 24%.

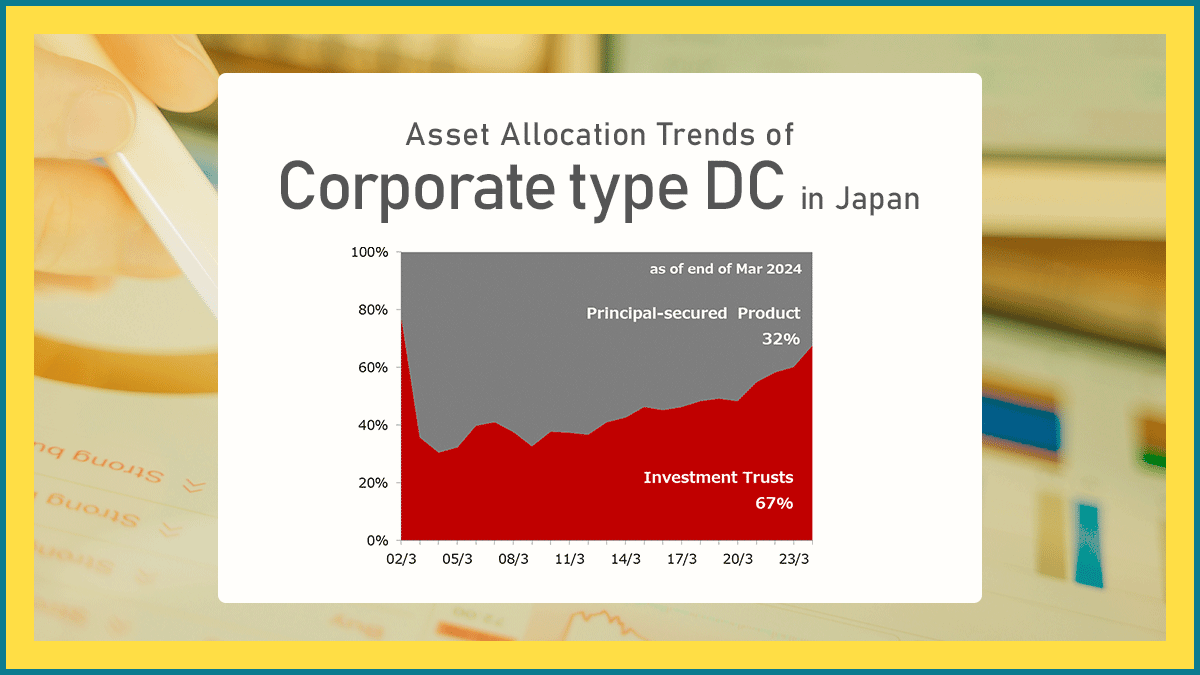

With a downward trend in retirement benefits, it is likely that more self-help efforts will be needed to build assets for retirement.

Perhaps in light of this situation, the government has been expanding tax-advantaged reserve and pension systems, and further improvements are expected in the future. To get started, check out your company’s retirement plan and see what you can use to build a brighter future.

Author: Daisuke Yabuuchi, Financial Wellbeing Department, Nomura Holdings Co., Ltd.

Last Updated and Published in English: October 31, 2025

Original publication date: October 4, 2023