Trivia about ‘Cash’ in Japan

A new banknote was issued in Japan on July 3rd, 2024.

The design of the banknote was changed for the first time in 20 years, since 2004. In this article, we will talk about some trivia related to cash.

1: Amount of bills in circulation in Japan

According to the Bank of Japan’s website,.

“On New Year’s Eve in 2024 (2024), households, businesses, and financial institutions issued a total of 124.1 trillion yen (18.7 billion bills) in bank notes. When stacked, they reach about 1,870 kilometers (about 495 times the height of Mt. Fuji). When placed side by side, the distance is approximately 2.91 million km(It’s about 73 times the distance to the earth and about 8 times the distance to the moon.).”

If you think that the amount of bills in Japan alone is equivalent to 73 times around the globe, that is a huge amount.

2: Amount of coins in circulation in Japan

Next, let’s look at coins. Don’t you think there are fewer opportunities to take money out of your wallet these days? Unless I can only pay in cash, I mostly pay with my card or smartphone, so I withdraw money at an ATM once a month or so.

Let’s take a look at the current amount of coins in circulation (December 2024).

Amount of coins in circulation (December 2024)

| ¥500 | ¥100 | ¥50 | ¥10 | ¥5 | ¥1 |

|---|---|---|---|---|---|---|

Amount of coins | 45 | 107 | 42 | 187 | 101 | 364 |

The top currency in circulation was “¥1”, slightly more than twice as high as second, followed by “¥10” and “¥100”. The smallest number is “¥50” which is less in circulation than “¥500”.

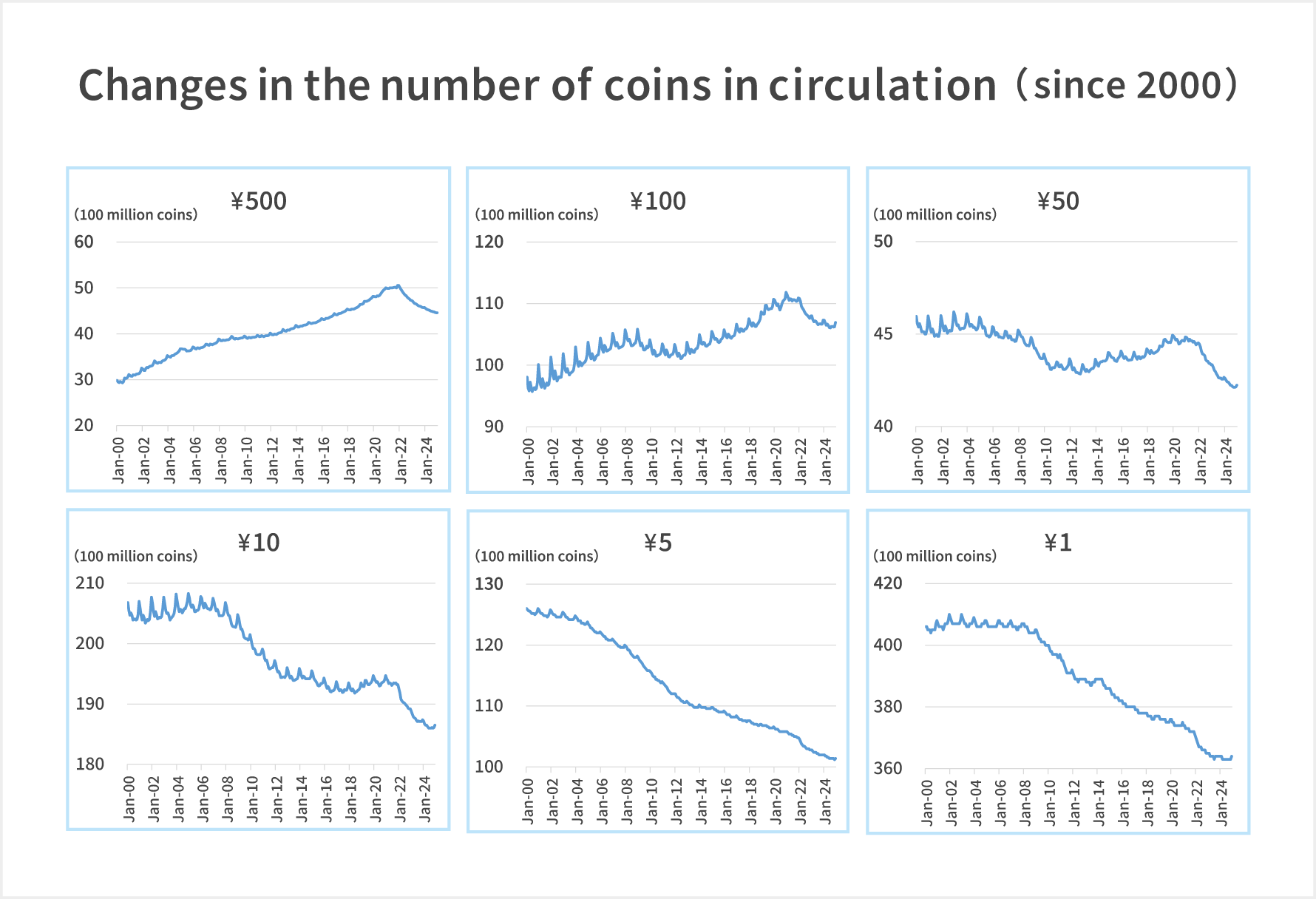

The following shows the changes in the amount of coins in circulation from January 2000 to December 2024. Looking at the changes in time series, there are interesting trends.

Changes in the number of coins in circulation (since 2000)

As shown above, the amount of ¥500 and ¥100 coins in circulation has increased compared to January 2020, while ¥50, ¥10, ¥5, and ¥1 coins have decreased.

The amount of ¥500 coins in circulation has declined since its peak in December 2020, and the amount of other coins has accelerated since a similar period.

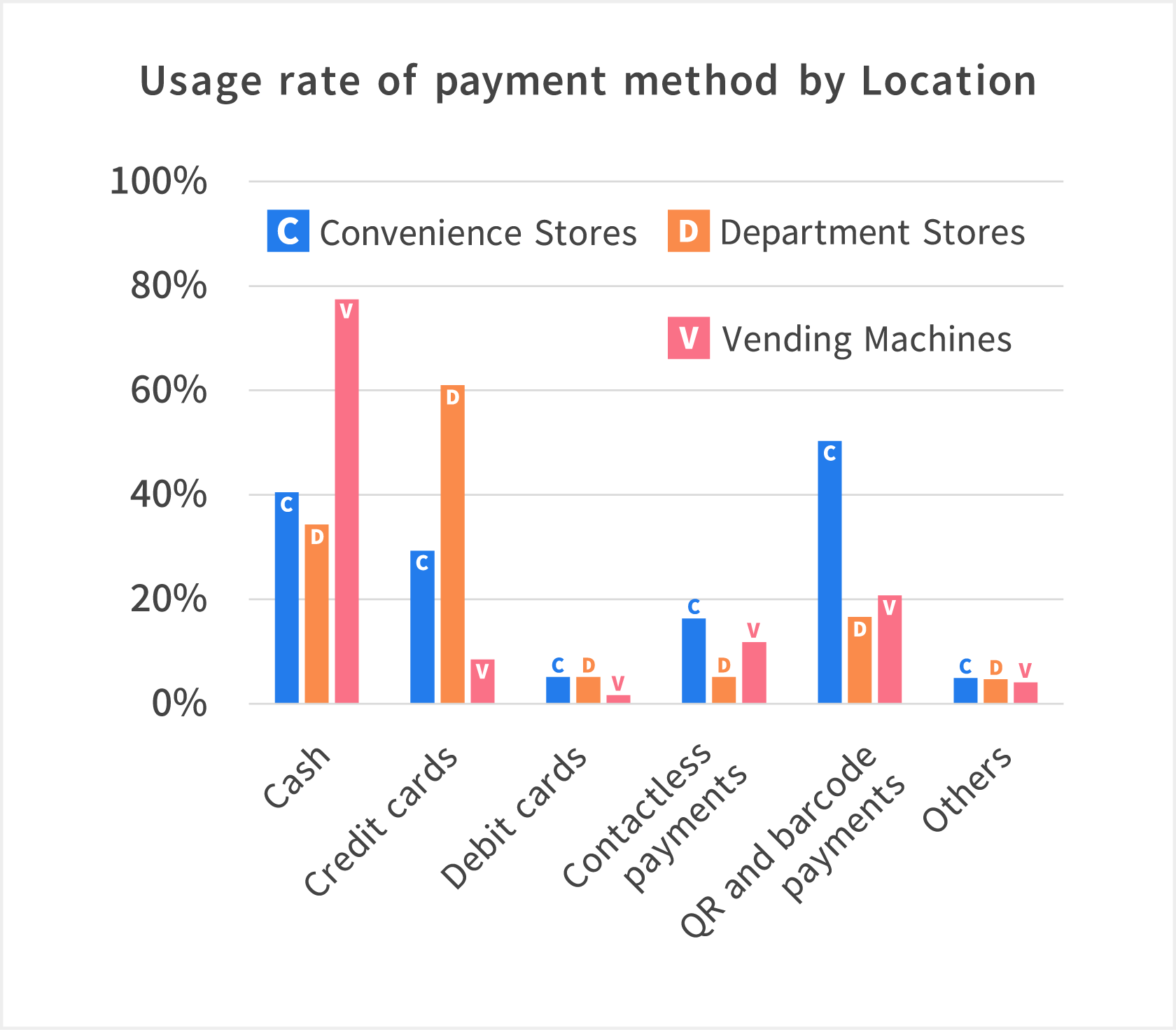

3: Payment methods tend to vary depending on the payment location.

The graph above shows the results of a survey on payment methods at convenience stores, department stores, and vending machines. The top 3 for each category are as follows.

- Convenience stores: QR/barcode payment, then cash, then credit card

- Department stores: Credit card, then cash, then QR/barcode payment

- Vending machines: Cash, then QR/barcode payment, then contactless payment

It seems that cash is used to a certain extent in all of these places, but it seems that people change their payment methods depending on the place of payment.

Daisuke Yabuuchi, Financial Well-Being Dept, Nomura Securities Co., Ltd.

This column has been prepared by Nomura Securities Co., Ltd. based on data deemed reliable as of June 2025, and is not guaranteed to be accurate or complete. It is subject to change in the future. All rights to any part of this document belong to Nomura Securities Co., Ltd., and may not be reproduced or transmitted by any means, electronic or mechanical, for any purpose without permission.

Published in English: July 18, 2025

Last Updated: June 11, 2025

Original publication date: July 5, 2024