How old are you going to retire?

This article explains the working situation of elderly people in Japan, comparison with employment in other countries, and the major reason they work.

1. At what age should you retire?

Some of you may only have a vague image of “I’ll work until the retirement age set by the company regulation, and then I will decide whether to work again depending on my financial situation.”

First, look at the number of people over the age of 60 working in Japan.

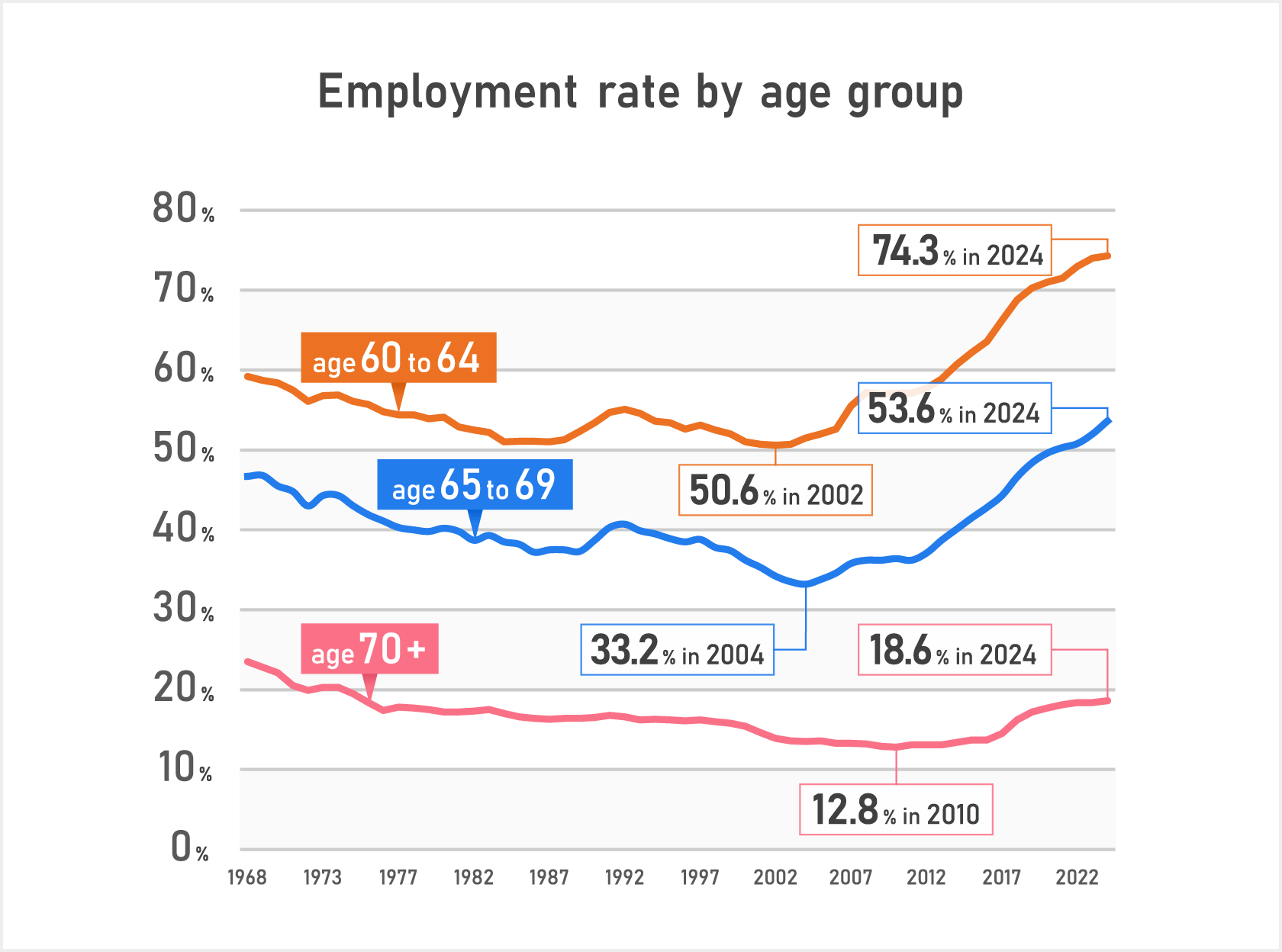

The employment rate of people aged 60 and over is as follows:

60 to 64: About 3 out of 4 (74.3%)

65 to 69: More than half (53.6%)

70+: More than 1 in 6 (18.6%)

2. Why are people over 60 working?

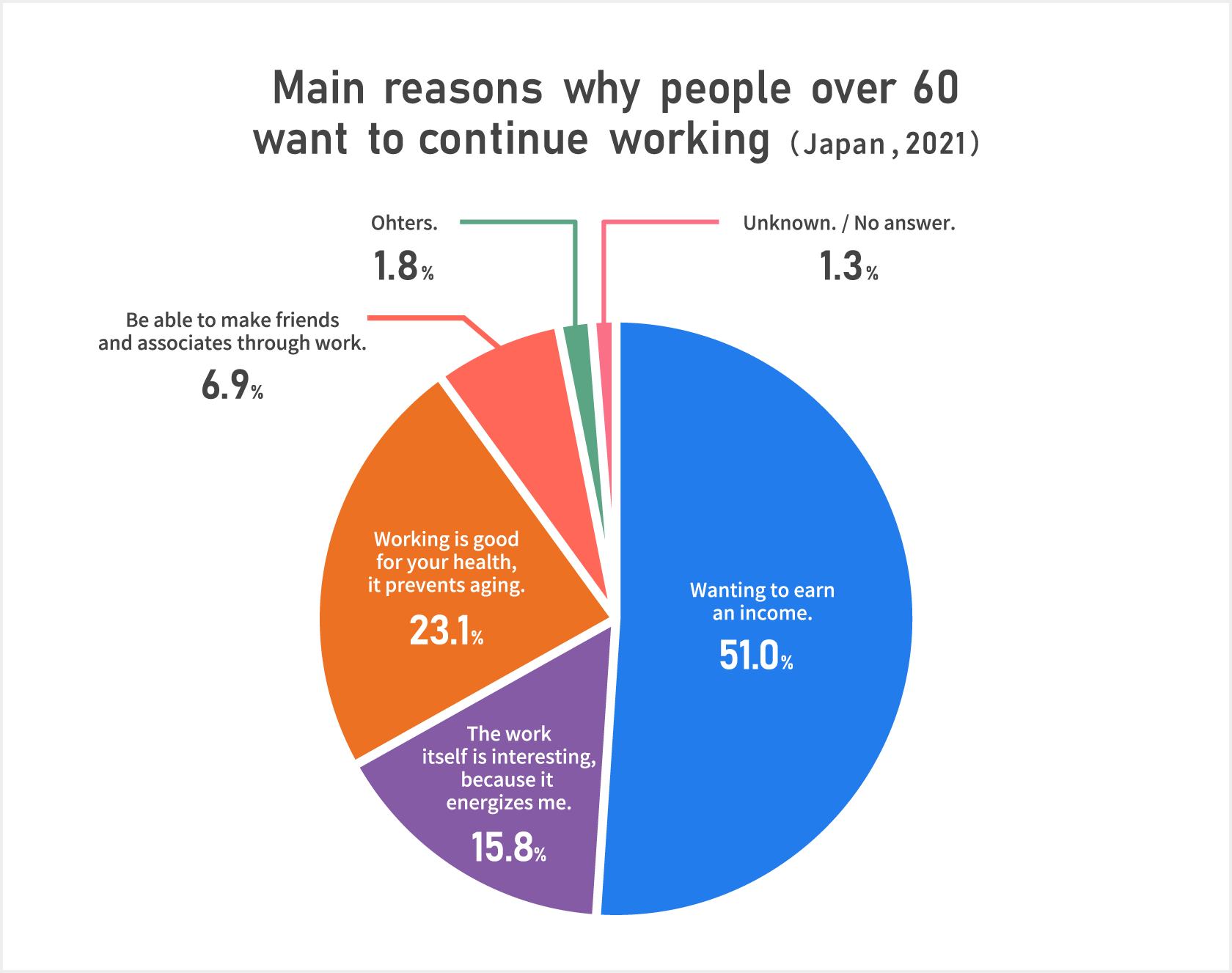

So why are people over 60 working?

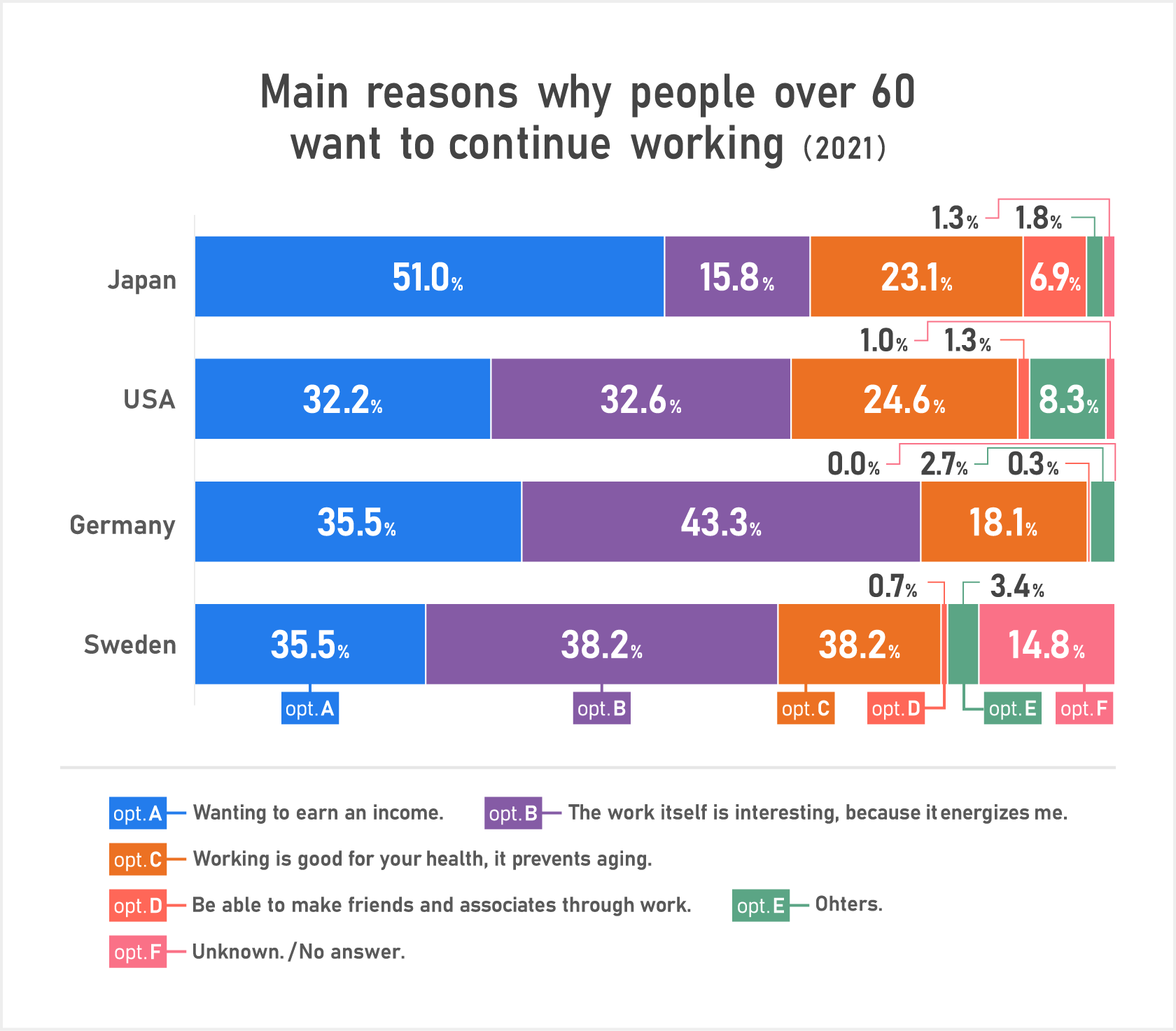

According to “Annual Report on the Aging Society (2021)”, more than half (51%) of the reasons for people over 60 working are economic reasons, such as wanting to earn an income.

The second major reason was “Working is good for your health, it prevents aging.” (23.1%).

The third common answer was “The work itself is interesting, because it energizes me” (15.8%).

Annual Report on the Aging Society presents the results of the same survey conducted in the United States, Germany, and Sweden.

In all the countries listed above, except Japan, the top reason for working was “The work itself is interesting because it energizes me.” and the second most common answer was “I want an income”

3. Income replacement rate in the countries surveyed

Here, we compare the income replacement rate in the countries surveyed above.

The income replacement rate is the ratio of the amount of pension at the time of starting to receive a pension compared to the take-home income of the working generation. Life expectancy indicates how many more years a person of a certain age can live.

The following table shows the income replacement rate and life expectancy of each country, according to the OECD report “Pensions at a Glance 2023” Japan’s income replacement rate is 38.8%, which is far below that of other countries, while the life expectancy of 65-year-olds is 22.5 years, which is higher than that of other countries.

Net Pension replacement rate by earnings and life expectancy at age 65 in each country

| Countries | Net Pension Replacement Rate by earnings | Life expectancy at age 65 (years) |

|---|---|---|

| Japan | 38.8% | 22.5 |

| USA | 50.5% | 19.5 |

| Germany | 55.3% | 19.6 |

| Sweden | 65.3% | 21.1 |

Despite having a longer life expectancy than other countries, Japanese people have to live on pension income that is considerably lower than their income when they were working. This is why many people in Japan want to work and earn money even when they get older.

In Japan, it can be said that starting to save earlier and building greater assets is important.

Author: Daisuke Yabuuchi, Financial Wellbeing Department, Nomura Holdings Co., Ltd.

Published in English: August 8, 2025

Last Updated: August 1, 2025

Original publication date: April 5, 2023

This column has been prepared by Nomura Securities Co., Ltd. based on data deemed reliable as of June 2025, and is not guaranteed to be accurate or complete. It is subject to change in the future. All rights to any part of this document belong to Nomura Securities Co., Ltd., and may not be reproduced or transmitted by any means, electronic or mechanical, for any purpose without permission.