The Relationship Between Happiness and Money

These days, we often hear the words “Wellness” and “Wellbeing.” In Japanese, these words correspond to “happiness” and “health,” but in the United States, the “Financial Wellness Program,” which prefixes the word “Financial,” has become established for corporate employees. The reason behind this is that in the United States, employees’ biggest worries are related to money, and research shows that improving these worries can improve employee satisfaction and productivity.

In order to understand the current situation, Nomura Securities conducted a survey1 titled “The Financial Wellness Survey” in October 2023.

The survey asked not only questions related to money and finance, but also questions related to “life satisfaction” and the recent buzzword “engagement.”

In this article, I would like to introduce some of the survey results that I thought might be of interest to you, especially focusing on life satisfaction.

"Life satisfaction" and "Current financial and financial well-being"

The results are as follows, showing that the degree of satisfaction with one’s life and current financial and financial well-being are proportional.

We don’t know the cause-and-effect relationship, but there seems to be some connection between the two.

The results reminded me of the following quote.

“Life is not only a matter of money, but a life without money is hardly a life at all.

Without enough money, half the possibilities of life are closed off.”

Especially when you run out of money after retirement, life’s possibilities and things you want to do decrease considerably.

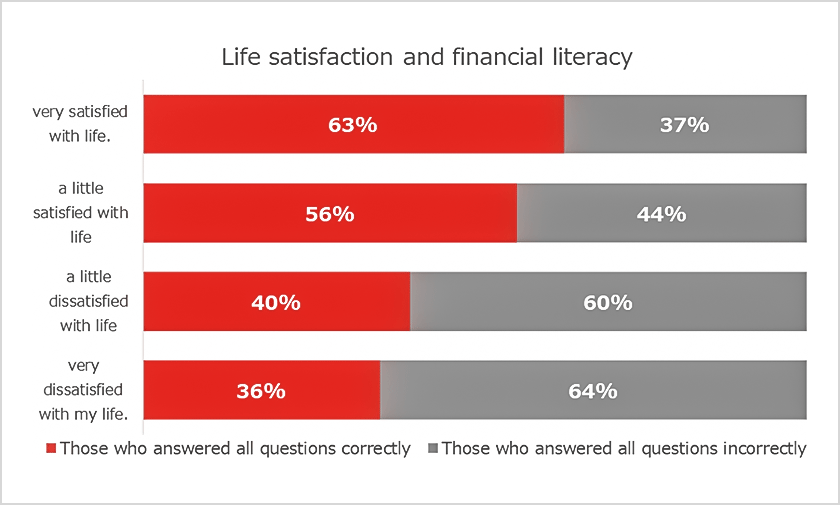

Life Satisfaction and Financial Literacy

There are five questions for financial literacy. Here, we analyzed the data of those who answered all the questions correctly and those who did not answer all the questions correctly, and life satisfaction.

As a result, it can be said that life satisfaction is somewhat proportional to financial literacy.

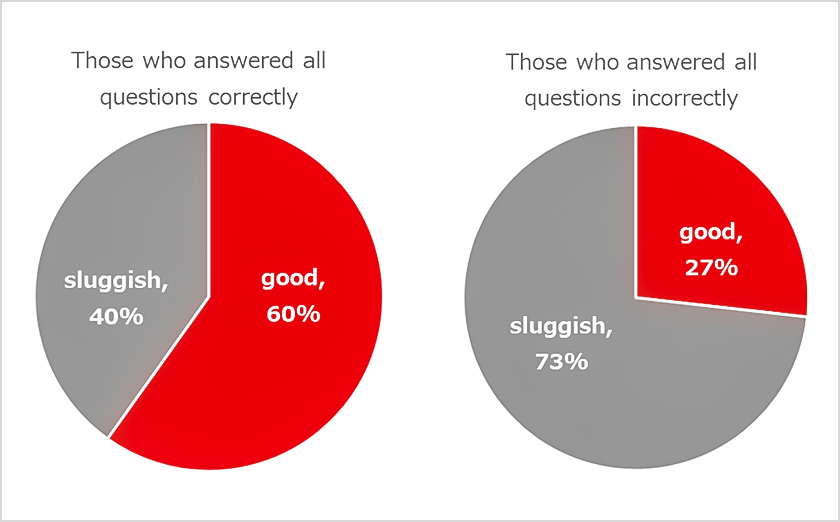

In addition, if we cross-analyze “current financial and financial well-being” and “financial literacy,” as mentioned above, the following results show that people with high financial literacy have a higher rate of financial and financial well-being.

Again, we cannot analyze the cause-and-effect relationship, but there is no harm in having financial knowledge.

According to the ancient Greek philosopher Plato,

“No matter how much knowledge you acquire, you cannot become omniscient,

but there is a difference between those who do not study and those who do not study.”

If you acquire financial knowledge, you will not be able to live a satisfying life immediately, but such knowledge will also become an element of living a satisfying life, and the accumulation of such knowledge will lead to life satisfaction.

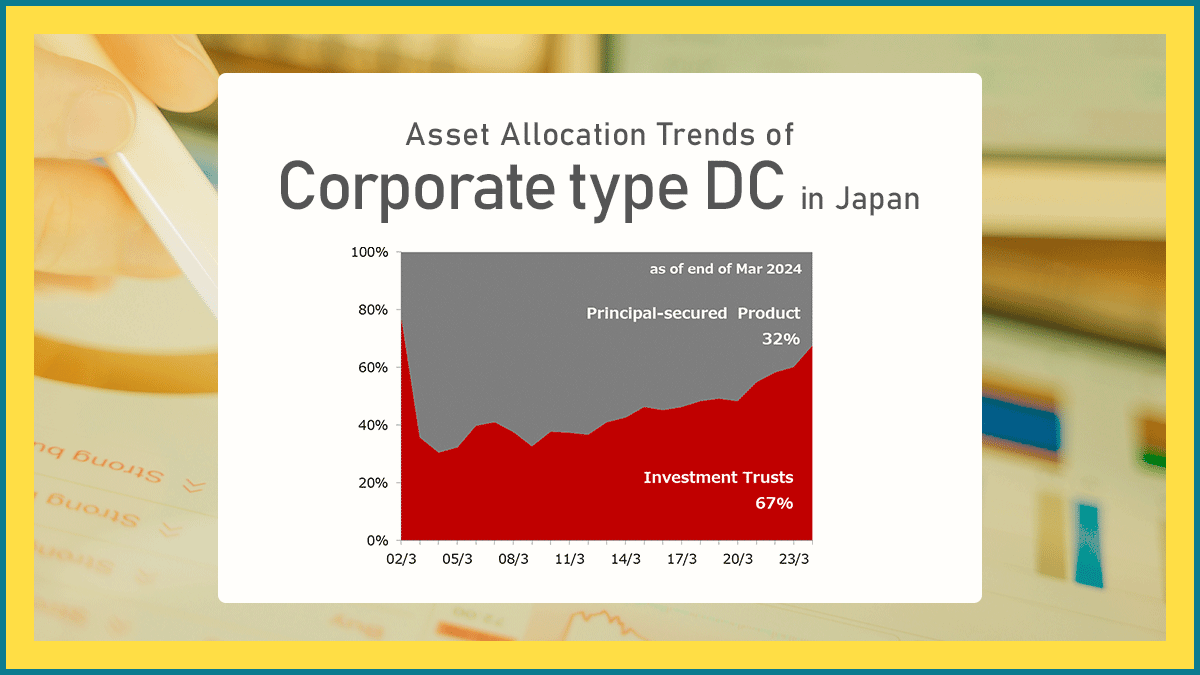

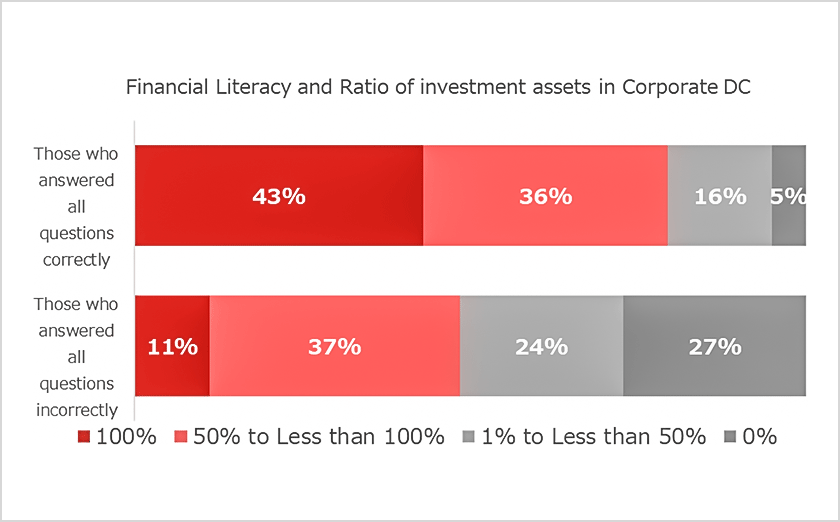

Speaking of accumulation, in terms of investment, it is called “accumulated investment.” When we cross-analyze the allocation ratio to investment funds in corporate type DC (Defined Contribution pension plan), which is one type of accumulated investment, and the results of the questionnaire on financial literacy, we can see as follows that people with high financial literacy tend to have a high allocation ratio to investment trusts.

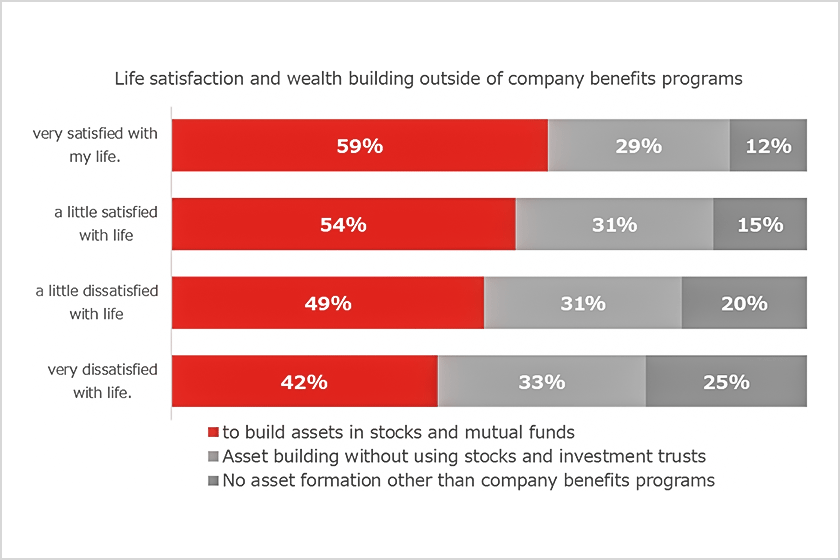

"Life satisfaction" and "Asset formation outside the company's welfare system"

In the questionnaire, we also ask whether or not you have implemented asset formation outside the welfare system and the products you use. When we cross-analyze this with life satisfaction, we can see a certain proportional relationship between high life satisfaction and asset formation outside the welfare system in stocks and investment trusts.

Warren Buffett, known as the god of investing, said,

“Do not save what is left after spending; instead spend what is left after saving.”

It’s easier said than done, but it’s certainly true, and we want to keep it in mind.

To summarize what we’ve seen so far,

- there is a certain correlation between life satisfaction, financial well-being, and financial literacy.

- People with high life satisfaction tend to be more willing to build assets, and the proportion of people who build assets outside of company benefits is relatively high.

- People with high financial literacy tend to be more willing to invest in corporate DC.

- People with high life satisfaction tend to be more willing to invest in stocks and mutual funds.

That is the case.

Why don’t you gain financial knowledge, build more assets, and become happier?

1 Source: Nomura Securities’ 3rd Financial Wellness Survey

Date of survey: October 3, 2023 to October 13, Number of respondents: 11,052, Internet

All data in this column is based on responses to the questionnaire.

All content in this column is the author’s personal opinion and does not represent the official opinion of Nomura Securities.

Author: Daisuke Yabuuchi, Financial Wellbeing Department, Nomura Holdings Co., Ltd.

Published in English: July 4, 2025

Published: July 5, 2024

This column has been prepared by Nomura Securities Co., Ltd. based on data deemed reliable as of June 2025, and is not guaranteed to be accurate or complete. It is subject to change in the future. All rights to any part of this document belong to Nomura Securities Co., Ltd., and may not be reproduced or transmitted by any means, electronic or mechanical, for any purpose without permission.